Candlestick Pattern - Dumpling Tops and Frypan Bottoms

Dumpling top and frypan bottoms. Someone must have been hungry when they thought of these names !!

Dumpling Top Candlestick Pattern

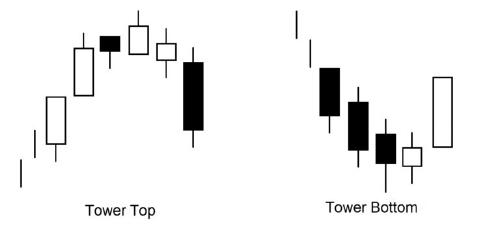

Several Japanese candlesticks form the top structure of a dumpling. With a small body, the first candlesticks are bullish or bearish. This candlestick arrangement should form a rounded top. Following that, a final candlestick is formed with a bearish gap opening.

When small real body candlesticks slowly rise and then move in a neutral to downward direction, a dumpling top occurs. When a bearish candlestick gaps down from the other candlesticks, the dumpling top pattern is complete.

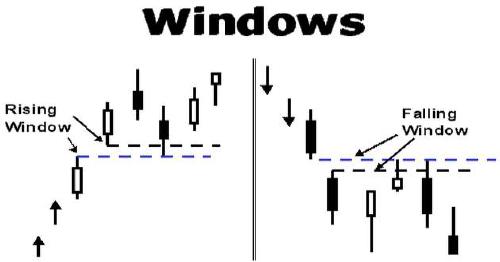

As the market forms a convex pattern, the dumpling top usually has small real bodies. A dumpling top is confirmed when the market gaps down. This is the same pattern as the Western rounded bottom top. As proof of a top, the dumpling top should have a bottom window.

Notes:

– Normally, this would indicate a Bearish reversal of the current Trend.

– It occurs during an uptrend, and the candles that follow the Pattern must confirm it.

– The Pattern begins during an Uptrend, then becomes a “Sideways” Trend (representing market indecision); at the end of the Pattern, the Trend reverses direction and becomes a Downtrend.

– This Pattern is quite rare; it is important that there is a Gap Down after the “Sideways” Trend and just before the Downtrend begins (To obtain a further confirmation of the reversal of the Trend, as the Pattern suggests).

Dumpling Top Chart Example

The chart above depicts a dumpling top. Take note of how the top of the chart above has many small-bodied candlesticks that are mostly neutral. This demonstrates that neither the bulls nor the bears have complete control of this consolidation area. The dumpling top pattern is confirmed when a strong bearish candlestick gaps down away from the area of consolidation, and prices are expected to fall further.

Frypan Bottom Candlestick Pattern

The fry pan bottom pattern is the inverse of the dumpling top pattern. When small real body candlesticks move slowly downward and then in a neutral to upward direction, the fry pan bottom occurs. When a bullish candlestick gaps up from the rest of the candlesticks, the fry pan bottom pattern is complete.

When a bullish candlestick gaps up from the rest of the candlesticks, the frypan bottom pattern is complete.

The bottom of the fry pan represents a market that is bottoming and whose price action forms a concave design before opening a window to the upside. It looks like a Western rounded bottom, but the Japanese fry pan bottom should have a window in an upmove to confirm the bottom.

Notes:

– Normally, this would indicate a Bullish reversal of the current Trend.

– It occurs during a downtrend, and the candles that follow the Pattern must confirm it.

– The Pattern begins during a Downtrend, then becomes a “Sideways” Trend (representing market indecision); at the end of the Pattern, the Trend reverses direction and becomes an Uptrend.

– This Pattern is quite uncommon; it is critical that there is a Gap Up after the “Sideways” Trend and just before the start of the Uptrend (To obtain a further confirmation of the reversal of the Trend, as the Pattern suggests).

Frypan Bottom Chart Example

The diagram above depicts the bottom of a fry pan. Take note of all the small bodied candlesticks in the consolidation area after prices fell. A large bullish candlestick gapped up and away from the area of consolidation, confirming a fry pan bottom.

Use the share button below if you liked it.

It makes me smile, when I see it.