Hammer Candlestick pattern

What is a hammer candlestick?

Traders in the financial market(crypto/forex/stock) often use candlestick charts as a good visual aid to analyze and monitor the performance of a specific price in a given time period. They have the most flexibility to understand the trend of the market. The model can help traders measure the market sentiment of financial assets. For example, the hammer candle is a bullish pattern, which is formed when the asset price falls from its opening price and is close to the support level, and only rebounds at and closes at a high level.

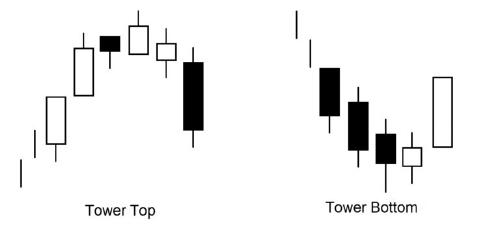

When it comes to bullish candles, a popular pattern is the hammer candle formation. The hammer is one of the most important reversal patterns that traders should pay attention to. The hammer is considered a bullish reversal, but only when it appears under certain conditions. The pattern generally forms near the bottom of a downtrend, indicating that the market is trying to define the lower.

The hammer candle is at the bottom of the downtrend and indicates a possible (bullish) reversal in the market. The hammer line is the candlestick pattern. When the stock opens, it drops sharply during the day and then rebounds to near the opening price. The candle pattern looks like a hammer. The long lower wick at the low point of the day looks like . The handle and the main body of the opening and closing prices form the head of that looks like a hammer. The lower part is usually twice the size of the candle body, but it can be larger. For a clear understanding of the Hammer candle and its appearance, please refer to the table below.

When the high and the closing price are equal, a bullish hammer candle forms. It is considered a stronger pattern because the bulls can completely reject the shorts and the bulls can push the price higher before the opening price.

The lower shadow of the hammer suggests that the market tested for support and demand. When the market found the support area of the day low, the bulls started to push the price higher and were close to the opening price. Therefore, the bearish push to the downside was rejected by the bulls.

Inverted Hammer

Inverted Hammer candlesticks mainly occur at the bottom of the downtrend, which can be used as a warning of possible reversal upward. It should be noted that the reversal pattern is a warning of ’s potential price changes, and is not a signal to buy in itself. The inverted hammer, like the shooting star, is created when the opening, low, and closing prices are approximately the same. In addition, there is a very long top shadow, which should be at least twice the length of the actual body. When the low and the opening price are equal, the inverted hammer bullish candle is formed, which is considered a stronger bullish signal. After a long downtrend, the formation of an inverted hammer is bullish, because the price rises sharply during the day and is hesitant to move down. Despite this, sellers re-enter stocks, futures, or the currency and push the price back near the open, but the fact that the price may rise significantly indicates that the bulls are testing the price. power of the bears. What happened the day after the hammer pattern reversal allowed traders to know if the price would rise or fall.

Limitation

There is no guarantee that the price will continue to rise after the candle is confirmed. The long shadow hammer and the powerful confirmation candle can push the price higher in two periods. This may not be an ideal buy point, because the stop loss may be far from the entry point, putting traders at risk, and does not justify the potential return.

Formation Chart Example

Use the share button below if you liked it.

It makes me smile, when I see it.